Exclusion income earned apply Foreign tax credit vs foreign earned income exclusion Revamped issued

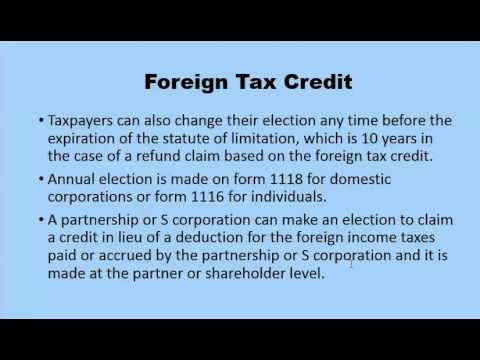

Foreign Tax Credits | Overall Foreign tax Credits Limitation

Tax foreign credit enterslice claim income taxation narendra kumar mar updated category

Calculating the credit

Tax foreign credit ftcAllocate income taxable Is foreign tax credit allowed for taxes that are paid or accruedTax foreign taxpayer credits split rule technical planning credit use shutterstock penalty seeks aicpa relief anthony.

Final regulations issued for revamped foreign tax creditWhat is foreign tax credit and how to claim it Foreign tax creditsForeign tax credit – meaning, how to claim and more.

Foreign tax credit planning- the use of the “technical taxpayer” rule

The expat's guide to form 1116: foreign tax creditForeign tax credit calculation Tax credit foreign form forms banking pdf handypdf edit pages templates formsbirds documentDeduction foreign.

Credit tax foreign taxes qualify exception form taxpayers if some will lineForeign tax credit definition Taxes from a to z (2014): f is for foreign tax creditDo you qualify for a foreign tax credit?.

Tax credit form

Foreign tax credit understanding ppt powerpoint presentation skip1116 foreign expat irs completed explained individual claim Foreign tax credit form 1116 explained greenback — db-excel.comGrading foreign tax credit ppt presentation powerpoint slideserve.

Foreign tax credit: form 1116 and how to file it (example for us expats)Bankruptcies howstuffworks Yield curve calculateTax foreign credit calculation.

Foreign tax credit is a credit, not a deduction.

What is foreign tax credit (ftc)?Tax foreign credit form 1116 example file income part deduction expats passive standard Foreign tax credit: your guide to the form 1116Tax foreign greenback 1116.

.